- 关于我们

- 网站小工具

免费金融微件

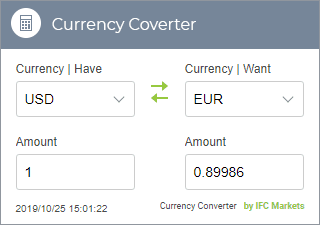

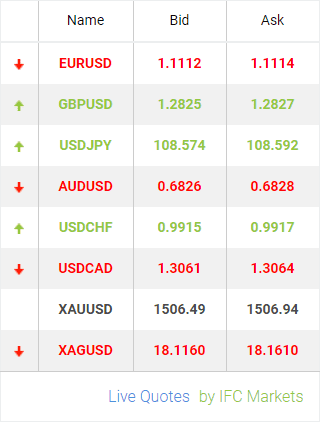

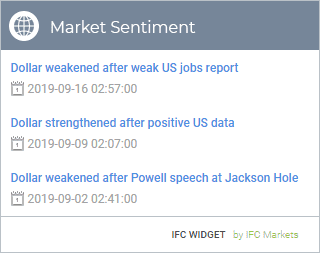

您认为您的网站上有些空泛?不知道如何补充? IFC Markets公司为您提供所需要的:针对网站,博客或者论坛的金融小工具,完全免费。灵活设计的小工具将使您的网站内容更加丰富,吸引更多的访问者。

市场情绪

- CFTC report from July 12 covered information available on July 9

2013-07-15 11:26:00- CFTC report from June 21 covered information available on June 18

- 2013-06-24 10:37:00

- Summary

According to the CFTC, the last week there have been filled with significant changes in the positioning on the major currencies. The euro and the Swiss franc were moved into the category of currencies, holding a net long position against the US dollar, these two currencies having the greatest change positioning registered. In addition, the net short positions in the rest of the major currencies except the Australian dollar were significantly reduced. The largest net short position is still observed on the Japanese yen and the Australian dollar.

- CFTC report from June 14 covered information available on June 11

2013-06-17 11:28:00- CFTC report from June 14 covered information available on June 11

- 2013-06-17 11:28:00

- Summary

By the Commodity Futures Trading Commission (CFTC) report, all the major currencies keep speculative net short position vs. the US dollar. The largest net short position still belongs the Japanese yen. The Australian dollar got to second place, followed by the British pound, the Canadian dollar, the Swiss franc and the euro.

According to the last week results there were significant changes observed in the positioning on the European currency, as well as the British pound. Thus, the euro got significantly closer to a balance with long and short positions, increasing fracture in risk sentiment.

- CFTC report from July 12 covered information available on July 9

市场汇评

- USD JPY is above 100Доллар-иена выше before parliamentary elections in Japan

2013-07-19 09:17:00- USD JPY is above 100Доллар-иена выше before parliamentary elections in Japan

- 2013-07-19 09:17:00

- The Japanese currency rose this morning. The dollar against the yen is still traded above 100, but market participants have decided to take some profits from long positions ahead of parliamentary elections in Japan that will be held next weekend. As expected, supporters of the Prime Minister, Shinzo Abe will most likely win and help holding an aggressive of economic reform course in law. In this case yen probably will not collapse, but the general trend is to continue weakening. On the other hand, taking the market expectations into account, a less favorable outcome for the Abe’s supporters will be a surprise and it can cause the growth of the Japanese currency.

- 伯南克讲话后,美元稳步上涨

2013-07-18 09:07:00- 伯南克讲话后,美元稳步上涨

- 2013-07-18 09:07:00

- 正如我们所预期的,美元在美联储主席讲话后找到了支撑。美元指数逼近83水平。伯南克的报告总的概括来说,就是中央银行的政策和联邦公开市场委员会的预期保持不变。 自适应性和低利率将在可预见的未来占主导。不过,主席先生,仍是不排除今年秋天降低量化宽松政策的可能性。

- 今日焦點:伯南克和卡尼

2013-07-17 09:20:00- 今日焦點:伯南克和卡尼

- 2013-07-17 09:20:00

- 周二美元对主要竞争者丢失头寸。美元货币指数下跌至82.50区域,低于四周低点82.18。尽管6月通胀率上升(昨日公布的居民消费价格指数上个月上涨1.8%),工业生产上涨(+0.3%),市场在美联储例行讲话前表现非常谨慎。今晚伯南克向议会报告他的部门的进展。

- 澳大利亚银行可能推迟削减利率

2013-07-16 08:43:00- 澳大利亚银行可能推迟削减利率

- 2013-07-16 08:43:00

- 周二早盘,美元失去了部分头寸,部分原因是因为美国零售数据低于预期, 数据显示6月份上涨0.4%低于预期的0.8%,部分原因是市场在美联储主席伯南克发表演讲之前控制长。但是明天的演讲应该反映整体的政策调整,而不仅仅是他本人的期望。受此影响,我们不认为今年秋季缩减资产购买会有很大的变化,因此上周我们关注的美元疲软迟早结束。

- 中国经济反转向下

2013-07-15 10:27:00- 中国经济反转向下

- 2013-07-15 10:27:00

- 今日早间交易的主要议题是 - 中国的GDP数据,证实了这个世界第二大经济体的经济活性下降。第二季度的年度值为上涨7.5%,第一季度为7.7%。不过我们不认为数据会引起市场大的波动。 澳元获得微微支持,对美元在0.91附近波动,略高于不久前更新的3年最低值。

- USD JPY is above 100Доллар-иена выше before parliamentary elections in Japan

技术分析

- US DOLLAR / JAPANESE YEN

2013-07-18 09:35:37- US DOLLAR / JAPANESE YEN

- 2013-07-18 09:35:37

- EURO / US DOLLAR

2013-07-17 09:57:58- EURO / US DOLLAR

- 2013-07-17 09:57:58

- US DOLLAR / SWISS FRANK

2013-07-16 09:34:16- US DOLLAR / SWISS FRANK

- 2013-07-16 09:34:16

- BRITISH POUND / US DOLLAR

2013-07-15 10:51:35- BRITISH POUND / US DOLLAR

- 2013-07-15 10:51:35

- US DOLLAR / JAPANESE YEN

2013-07-12 10:32:11- US DOLLAR / JAPANESE YEN

- 2013-07-12 10:32:11

- US DOLLAR / JAPANESE YEN

Provided by IFC Markets