- 分析

- 技术分析

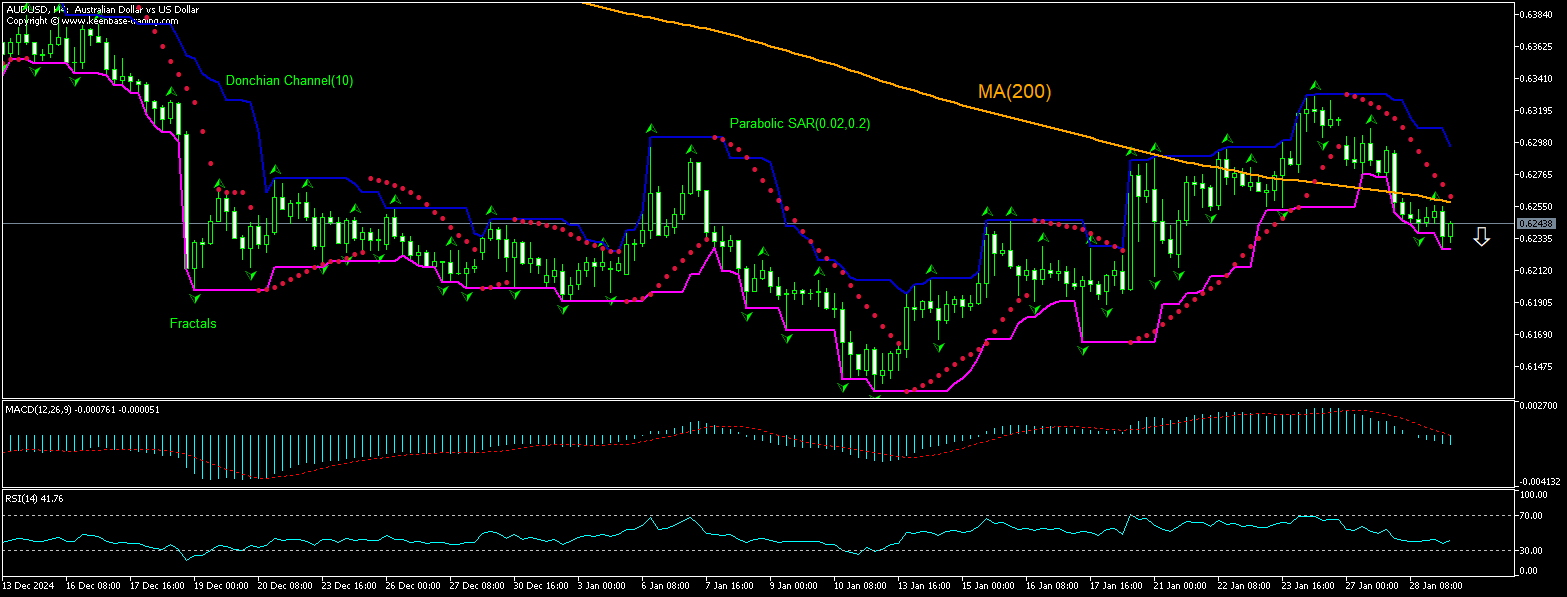

AUD/USD 技术分析 - AUD/USD 交易: 2025-01-29

AUD/USD 技术分析总结

低于 0.62262

Sell Stop

高于 0.62695

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 卖出 |

| Donchian Channel | 卖出 |

| MA(200) | 卖出 |

| Fractals | 卖出 |

| Parabolic SAR | 卖出 |

AUD/USD 图表分析

AUD/USD 技术分析

The technical analysis of the AUDUSD price chart on 4-hour timeframe shows AUDUSD,H4 is declining under the 200-period moving average MA(200) after breaching below MA(200) yesterday. We believe the bearish momentum will continue after the price breaches below the lower bound of the Donchian channel at 0.62262. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 0.62695. After placing the order, the stop loss is to be moved to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

外汇交易 基本面分析 - AUD/USD

Australia’s latest inflation data were softer than expected. Will the AUDUSD price retreating continue?

Australian Bureau of Statistics latest inflation data were weaker than expected: the monthly Consumer Price Index increased by 2.5% over year in December 2024, accelerating from 2.3% in the previous month. The reading was the highest since August and in line with market forecasts. At the same time Consumer Price Index growth decelerated to 2.4% in Q4 2024, down from 2.8% in Q3, and below the forecast of 2.5%. It was the lowest reading since Q1 2021, as goods inflation sharply eased (0.8% vs 1.4% in Q3) mainly due to steep declines in prices of electricity (-25.2% vs -15.8%) and fuel (-7.9% vs -6.2%) amid the ongoing impact of Energy Bill rebates. As a result of softer inflation data traders increased bets that the Reserve Bank of Australia will begin its easing cycle as early as February. Higher likelihood of interest rate cut by the Reserve Bank of Australia is bearish for Australian dollar and AUDUSD pair.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.