- 分析

- 技术分析

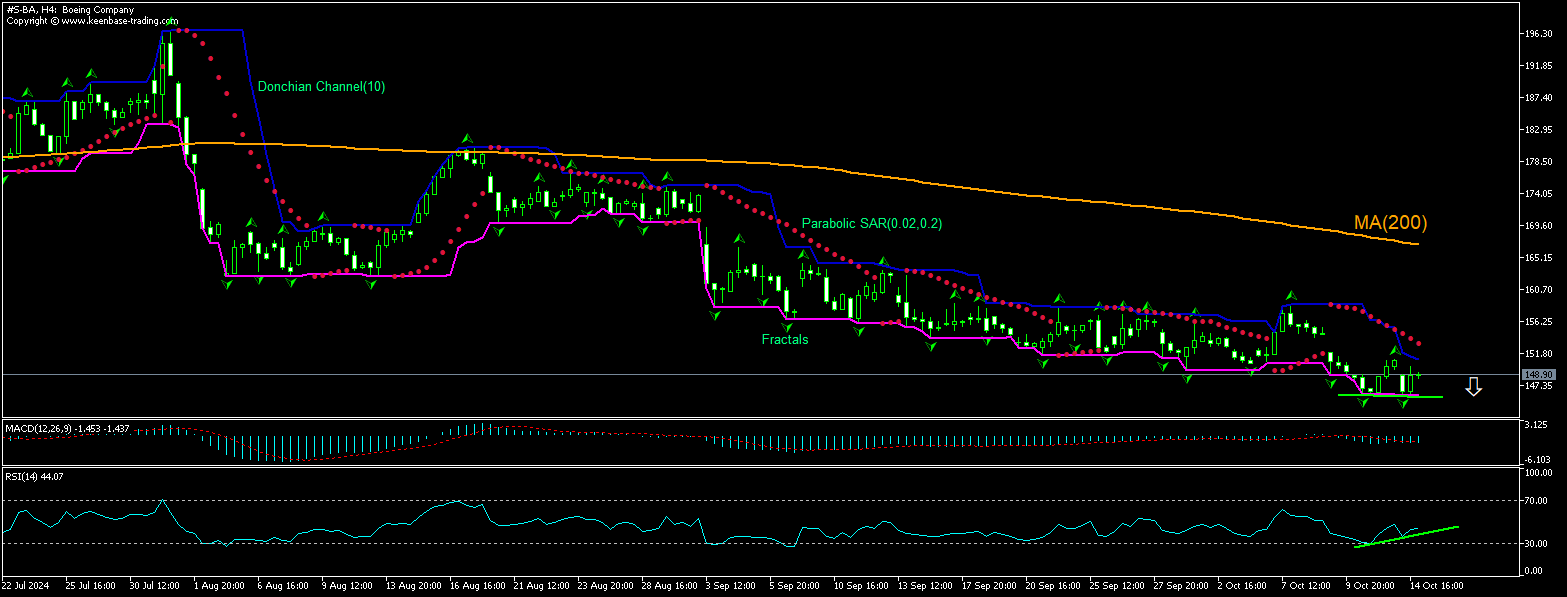

Boeing 技术分析 - Boeing 交易: 2024-10-15

Boeing 技术分析总结

低于 145.90

Sell Stop

高于 150.94

Stop Loss

| 指标 | 信号 |

| RSI | 买进 |

| MACD | 买进 |

| Donchian Channel | 卖出 |

| MA(200) | 卖出 |

| Fractals | 卖出 |

| Parabolic SAR | 卖出 |

Boeing 图表分析

Boeing 技术分析

波音公司股价4小时图的技术分析显示,#S-BA,H4在六周前测试MA(200)后,在200周期移动平均线MA(200)下方回调。 RSI指标已形成看涨背离。 我们相信,在价格突破145.90的Donchian通道下边界之后,看跌势头将继续。 这个级别可以作为一个入口点放置一个挂单出售. 止损可以放在150.94上方。 下单后,止损将每天移动到下一个分形高指标跟随抛物线信号。 因此,我们正在将预期利润/损失比率更改为盈亏平衡点。 如果价格达到止损水平(150.94)而没有达到订单(145.90),我们建议取消订单:市场发生了未考虑的内部变化。

股票 基本面分析 - Boeing

波音股票昨日收盘下跌,此前有报道称,数千名波音员工将在几周内收到裁员通知。 波音股价回落会持续吗?

自 9 月 13 日以来,约 33,000 名波音工人举行了罢工,要求在四年内将工资提高 40%。这家飞机制造商计划在其商业部门裁员 10%,包括工会和非工会工人。波音公司将在下个月向数千名工人发出为期 60 天的通知,其中包括商业航空部门的许多员工,这意味着这些员工将在 1 月中旬离开公司。如果需要,第二阶段的通知可能会在 12 月发出。裁员消息是在该公司周五盘后宣布裁员之后传出的,其中还包括777X喷气式客机的新推迟和民用767货机生产的结束。将777X的交付时间推迟一年至2026年是人们普遍预料之中的,但却引发了人们对该公司将不得不寻找新的资金来克服财务困境的担忧。阿联酋航空公司总裁蒂姆-克拉克(Tim Clark)评论说,“除非公司能够通过配股募集资金,否则公司面临着即将被下调投资评级的风险,破产保护迫在眉睫”。评级机构标准普尔(S&P)警告说,波音公司有可能失去其珍贵的投资级信用评级。大多数分析师预计,波音公司将通过股票发行筹集最多 150 亿美元的资金。由于波音面临飞机交付的进一步延迟,被迫裁员对股价不利。

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.