- 分析

- 技术分析

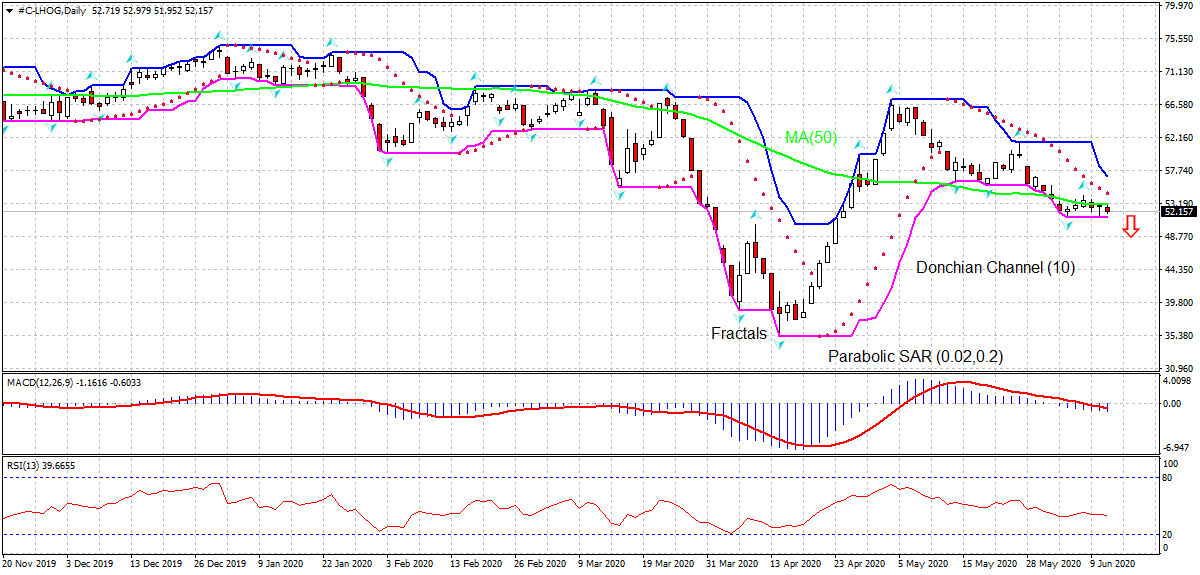

瘦猪肉 技术分析 - 瘦猪肉 交易: 2020-06-12

瘦猪肉 技术分析总结

低于 51.37

Sell Stop

高于 56.92

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 卖出 |

| Donchian Channel | 卖出 |

| MA(50) | 卖出 |

| Fractals | 卖出 |

| Parabolic SAR | 卖出 |

瘦猪肉 图表分析

瘦猪肉 技术分析

On the daily timeframe #C-LHOG: D1 has breached below the 50-day moving average MA(50), which is falling itself. We believe the bearish momentum will continue as the price breaches below 51.37. A pending order to sell can be placed below that level. The stop loss can be placed above 56.92. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

商品 基本面分析 - 瘦猪肉

US pork supply is increasing with the resumption of operation of US meat processing plants. Will the lean hog price continue falling?

Pork supply is recovering gradually as meat plants across US ramp up production following slowdowns after coronavirus outbreak. Meatpackers slaughtered 450,000 hogs on Monday, up from 417,000 a week ago according to US Department of Agriculture. However, in March they slaughtered up to 498,000 a day. And farmers still have a backlog of livestock after animals could not be slaughtered due to temporarily shut slaughterhouses during the coronavirus outbreak. The number of livestock being killed each day has rebounded from April and May, increasing the supply of pork. Rising pork supply is bearish for LHOG.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.