- 分析

- 技术分析

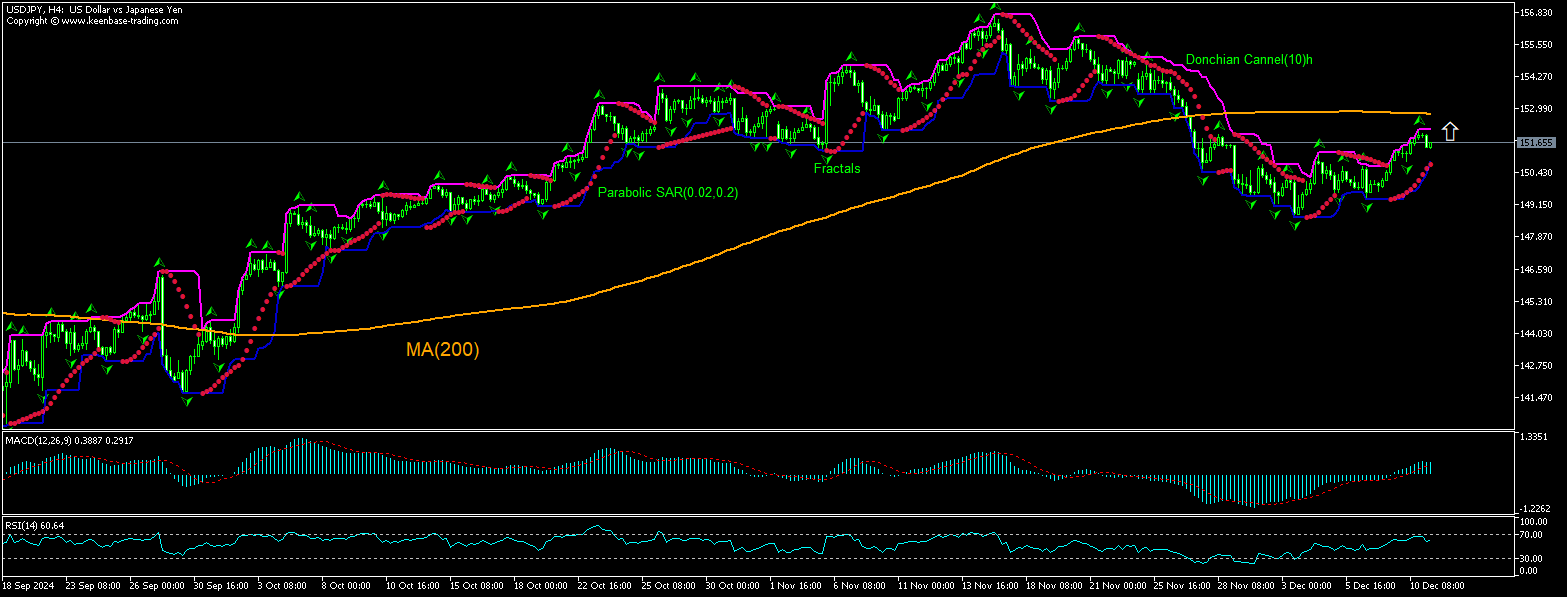

USD/JPY 技术分析 - USD/JPY 交易: 2024-12-11

USD/JPY 技术分析总结

高于 152.172

Buy Stop

低于 150.776

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 中和 |

| Donchian Channel | 买进 |

| MA(200) | 卖出 |

| Fractals | 买进 |

| Parabolic SAR | 买进 |

USD/JPY 图表分析

USD/JPY 技术分析

4小时图美元兑日元价格的技术分析显示,美元兑日元,H4在8天前触及两个月低点后,正在上涨测试200周期移动平均线MA(200)。 我们相信,在价格突破152.172的Donchian通道上限后,看涨走势将继续。 高于此的水平可以作为一个入口点放置一个挂单购买。 止损可以放在150.776以下。 下单后,止损将移动到下一个分形低点,跟随抛物线指标信号。 因此,我们正在将预期利润/损失比率更改为盈亏平衡点。 如果价格在未达到订单的情况下达到止损水平,我们建议取消订单:市场发生了未考虑的内部变化。

外汇交易 基本面分析 - USD/JPY

日本11月生产者价格通胀上升。 USDJPY价格反弹是否会逆转?

日本 11 月份生产者价格通胀率上升:日本央行报告称,日本 11 月份生产者价格指数(PPI)同比增长 3.7%,而 10 月份为 3.6%,预期为下降至 3.4%。与此同时,对大型制造商的调查结果显示,商业景气有所改善,BSI(商业调查指数)制造业指数从上一季度的 4.5 升至本季度的 6.3。高于预期的日本生产者价格通胀和商业乐观情绪对日元利好,对美元兑日元利空。然而,目前的走势对该货币对来说是看涨的。

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.