- 分析

- 技术分析

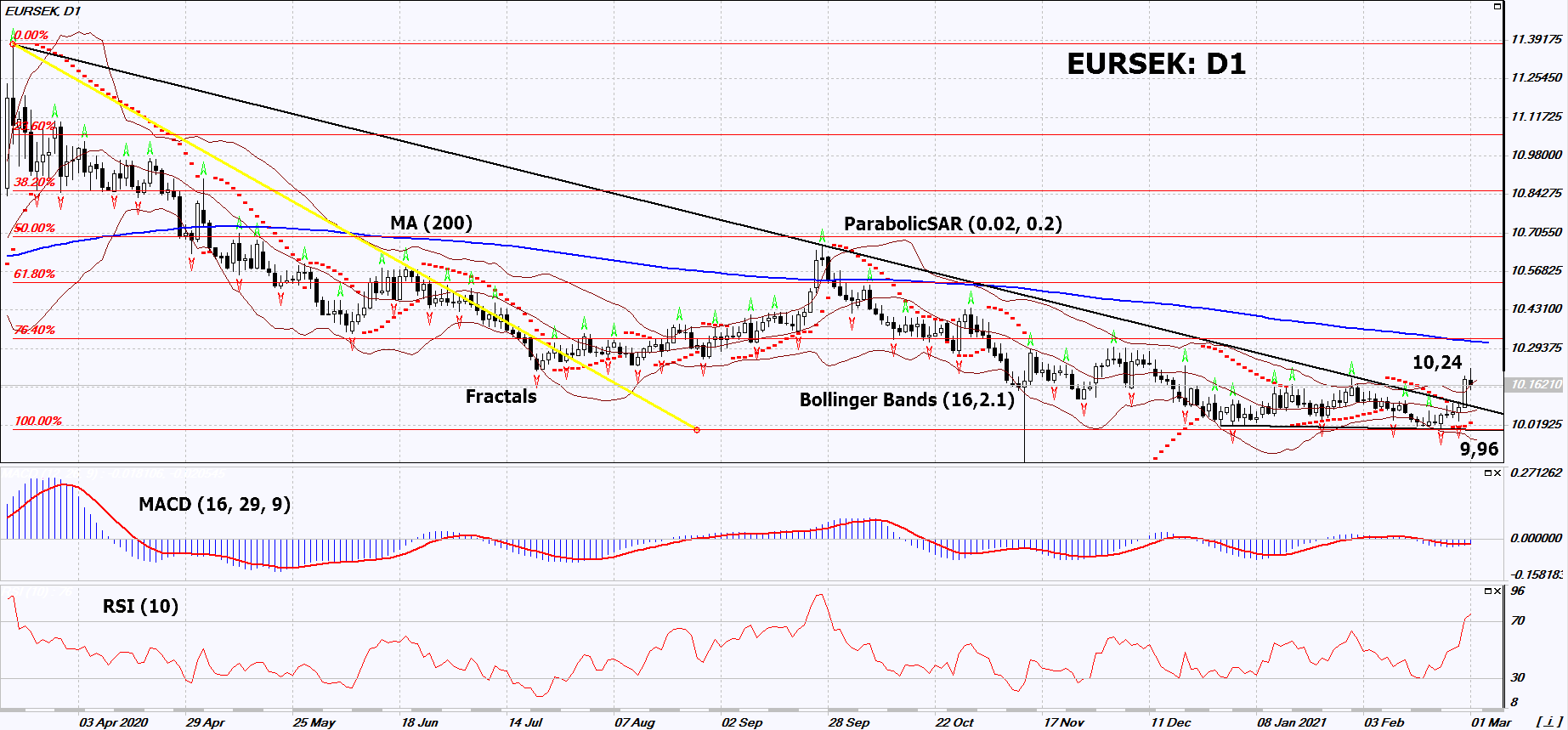

EUR/SEK 技术分析 - EUR/SEK 交易: 2021-03-02

EUR/SEK 技术分析总结

高于 10.24

Buy Stop

低于 9.96

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 买进 |

| MA(200) | 中和 |

| Fractals | 买进 |

| Parabolic SAR | 买进 |

| Bollinger Bands | 中和 |

EUR/SEK 图表分析

EUR/SEK 技术分析

On the daily timeframe, EURSEK: D1 broke upward the resistance line of the long-term downtrend and, at the same time, exited the short-term triangle. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish movement if EURSEK: D1 rises above its latest high: 10.24. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal, the lower Bollinger band, the last lower fractal and the 3-year low: 9.96. After opening a pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (9.96) without activating the order (10.24), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

外汇交易 基本面分析 - EUR/SEK

Weak macroeconomic data came out in Sweden. Will the EURSEK quotes rise?

The upward movement means the strengthening of the euro against the Swedish krona. Unemployment in Sweden in January this year rose to 9.3% from 8.2% in December last year. This is the maximum since June 2020. The decline in GDP in Q4 of last year was -0.2% (in quarterly terms), while an increase of +0.5% was expected. Swedbank Manufacturing PMI fell to 61.6 in February from 62.5 in January. It was expected to advance to 68.8. Similarly, the Eurozone’s Markit Manufacturing PMI rose to 57.9 in February from 54.8 in January, overperforming forecasts. The Swedish krona may be negatively impacted by the tightening of quarantine measures since March 1st in Sweden due to the increase in the number of coronavirus cases.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.